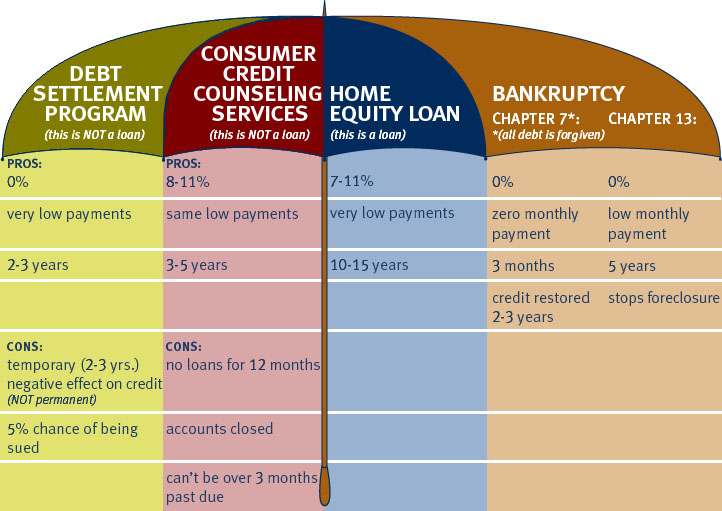

Debt Consolidation is an umbrella term that covers the four basic ways available to help you eliminate your debt.

Not every program is going to work for every person, so finding the right program for you and your situation is critical to becoming debt-free. With our free consultation, we’ll help determine which program is right for you, fits your needs and desires and works best for your particular situation.

How the Debt Settlement Program works is that you make a regular lower monthly deposit into an escrow account and as those funds build up in the account, we will get in contact with the creditors and negotiate a settlement for less than what you owe on any unsecured debt (credit cards, retail cards, personal loans, payday loans, repossessed vehicle loans, foreclosed home loans, second mortgages, some private student loans, etc.). Besides bankruptcy, the Debt Settlement Program is the fastest and cheapest way to eliminate all of your unsecured debts. This program is for people who are struggling to make their monthly payments, who don’t qualify for bankruptcy or don’t want to declare it, are tired of making monthly payments while not seeing their debt reduced, and/or are willing to temporarily sacrifice their credit to actually get out of debt.

Debt Settlement Program

The Debt Settlement Program is not right for everyone, but if it’s a good fit for you, it can be wildly successful. The program is designed to eliminate all of your unsecured debts in as little as 6-36 months. Debt Settlement is particularly successful for people that are on a fixed income, such as Social Security, unemployment, disability or retirement. One of the best things about this program is that you are in control of how it works. Our friendly professionals will work with you to determine a monthly payment that works best for you. Debt Solutions Network, LLC cannot tell you to stop making payments to your creditors, but if you continue to make regular monthly payments to them than they will neve

Debt Consolidation Pros

- Eliminate a portion of your unsecured debt

- Fastest way to become debt-free besides bankruptcy

- One lower monthly deposit/payment

- We stop creditor phone calls and harassment

- You’re in control of your deposits

- You choose what goes in so you can potentially still use a minor amount of credit.

Debt Consolidation Cons

- Temporarily negatively affects your credit and credit score

- Potential for litigation against you (getting sued)**

- In some states, a decrease in your credit score can possible increase insurance rates.

**[Debt Solutions Network, LLC is not a law firm and cannot provide any legal advice, this is for information purposes only.] This program does come with some risk, however. When you’re not paying on a legitimate debt, the creditor can take the option of trying to sue you to obtain what is owed to them. If they were to obtain a judgment against you, they could possibly put a lien against any property (home, land) you own, garnish your paycheck (if you receive a paycheck, cash jobs or fixed income are generally safe), or freeze/garnish your bank accounts (they must know where you bank and actually be able to take it). The process of obtaining a judgment and executing (putting on a lien or garnishing) on that judgment takes at the very least several months, so we can typically work something out with the creditor before that happens. It is a very rare occasion that any of this ever happens to our clients though, because we act as an intermediary between you and the creditors, we can usually avoid any of this from occurring.

Consumer Credit Counseling Services

Consumer Credit Counseling Services combines all of your unsecured debts into one monthly payment and that payment is spread out to all of your creditors each month. This is the most common form of debt consolidation in America and one of the reasons is that it doesn’t hurt your credit. Another reason people will enter into this program is to reduce the amount of interest they are paying each month in order to start paying down the debt. This program doesn’t have a very high success rate, however, because the payment is close to what you were paying monthly already, and there’s very little leeway on your monthly payments. If you’re struggling to make your payments each month, something will eventually come up that makes you unable to make that full monthly payment. If you miss more than one payment in a year, you will most likely be kicked out of the program and find yourself right back where you started. This program is also controlled by the creditors and credit card companies, so they are the ones deciding what you need to pay monthly, not you.

Consumer Credit Counseling Pros

- Won’t hurt your credit

- Eventually gets you out of debt

- Stops creditor calls and harassment

- One monthly payment

- Lowers interest rates

Consumer Credit Counseling Cons

- Typically takes 5 years to complete

- Not much, if any reduction in the amount you need to pay each month

- Very little to no flexibility in payments

- Cannot be more than 3-5 months behind to qualify

- Dictated by the creditors/credit card companies

- Not all creditors accept this program

- You cannot continue to use your credit accounts

Home Equity Loan

A Home Equity Loan is a loan from the equity accumulated on your home that is used to pay off your debts. It can be a successful way to eliminate high interest rates and combine all of your debts into one, hopefully lower, monthly payment. What we have noticed over the years, however, is that these do not usually help people remain debt-free. The main reason for this is that it doesn’t address one of the main causes of debt, overspending. Typically, when people use a Home Equity Loan to combine their debts they go right back to spending on the same credit cards that they just paid off. This will usually result in people putting themselves even further into debt and making their financial situation much more difficult to manage. Borrowing money to get out debt still leaves you with debt.

Home Equity Loan Pros

- Lowers interest rates

- One lower monthly payment

Home Equity Loan Pros Cons

- Take unsecured debt and secure it with your home

- Usually leads to an increased amount of debt

Bankruptcy

Chapter 7

Bankruptcy Pros

- Eliminate all unsecured debts

- Cheapest way to eliminate large amounts of debt

Bankruptcy Cons

- Temporarily eliminates/destroys credit

- Stays on credit report for 10 years

- Difficult to qualify for

- Can only declare once every 10 years

Chapter 13

Bankruptcy Pros

- Save your home

- Potential reduction in amount of debt

- Potential lower monthly payment

Bankruptcy Cons

- Temporarily eliminates/destroys credit

- Stays on credit report for 10 years

- Can only declare once every 10 years

- Still have to pay back what you owe plus interest if you don’t qualify for a reduction

- If unable to make the payments, then the courts will take it from you

- Can take years to complete

25 Comments

-

Hello to all, how is the whole thing, I think every

one is getting more from this website, and your

views are nice designed for new viewers.-

Well thank you, we like to share knowledge and information with everyone! Dealing with creditors, saving people money, and helping them become debt free is what we specialize in though. Well that and taking care of our clients of course!

-

-

I was just looking at your What is Debt Consolidation | Debt Solutions Network website and see that your website has the potential to get a lot of visitors. I just want to tell you, In case you don’t already know… There is a website network which already has more than 16 million users, and most of the users are looking for websites like yours. By getting your website on this network you have a chance to get your site more popular than you can imagine. It is free to sign up and you can find out more about it here: http://thfox.com/4ZDf – Now, let me ask you… Do you need your site to be successful to maintain your way of life? Do you need targeted traffic who are interested in the services and products you offer? Are looking for exposure, to increase sales, and to quickly develop awareness for your website? If your answer is YES, you can achieve these things only if you get your website on the service I am describing. This traffic network advertises you to thousands, while also giving you a chance to test the network before paying anything at all. All the popular blogs are using this network to boost their traffic and ad revenue! Why aren’t you? And what is better than traffic? It’s recurring traffic! That’s how running a successful site works… Here’s to your success! Find out more here: http://thfox.com/4ZDf

-

Hey there are using WordPress for your blog platform?

I’m new to the blog world but I’m trying to

get started and create my own. Do you require any html coding

knowledge to make your own blog? Any help would be really appreciated!-

Not that We know of

-

-

Hello my friend! I wish to say that this article is awesome, nice written and come with

approximately all important infos. I’d like to see extra posts like this . -

Wow, that’s what I was searching for, what a stuff!

present here at this blog, thanks admin of this website.-

You’re welcome 🙂

-

-

Hello, Neat post. There’s an issue with your website in web explorer, might test this?

IE nonetheless is the market leader and a good part of other people will omit your wonderful writing due to this

problem.-

I’m not sure which problem you’re referring to?

-

-

I’m really enjoying the design and layout of your website.

It’s a very easy on the eyes which makes it much more enjoyable

for me to come here and visit more often. Did you hire out a

developer to create your theme? Superb work!-

We hired http://marketingoriginals.co.uk/ to help us put it all together, but we also participated in the content and getting it all laid out to make it easy for clients and potential clients to easily use.

-

-

Hi, i think that i saw you visited my weblog so i came to

“return the favor”.I’m attempting to find things to enhance my website!I

suppose its ok to use a few of your ideas!!-

If we had any, we would share them, believe me 😉

-

-

Hmm it appears like your site ate my first comment (it was super long) so

I guess I’ll just sum it up what I had written and say, I’m

thoroughly enjoying your blog. I as well am an aspiring

blog blogger but I’m still new to everything.

Do you have any tips and hints for newbie blog writers?

I’d genuinely appreciate it.-

Sorry we do not have any good advice on this, we’re still trying to figure things out ourselves as you can see

-

-

Asking questions are really pleasant thing if you are not understanding something entirely, however this article presents good understanding

yet.-

If you have any questions please present them, i will be monitoring this much more frequently now!

-

-

Oh my goodness! Amazing article dude! Thank you so much, However I am

going through difficulties with your RSS. I don’t understand the

reason why I cannot join it. Is there anybody getting

similar RSS issues? Anybody who knows the solution will

you kindly respond? Thanx!!-

We’re working that issue, hopefully we’ll have it figured out shortly if it hasn’t already

-

-

I could not refrain from commenting. Perfectly written!

-

Excellent article! We will be linking to this particularly great

article on our site. Keep up the good writing. -

Just desire to say your article is as amazing.

The clarity in your post is just great and that i could assume you are a professional in this subject.

Fine together with your permission let me to grab your

RSS feed to stay updated with imminent post. Thanks a million and please keep up the

enjoyable work. -

I enjoy the article

-

Good information. Lucky me I recently found your blog by

chance (stumbleupon). I’ve bookmarked it for later!